Content

Five-year fixes have also been unveiled starting from 4.79percent with a 5percent fee. Fleet cut rates on its seven-year fixed rate mortgages earlier this month. Accord Mortgages, the broker-only lender owned by Yorkshire building society, has cut fixed rates on its buy-to-let mortgages by up to 0.29 percentage points, effective tomorrow .

- NatWest says that, for customers making lump sum overpayments in excess of 1,000, this will mean their monthly mortgage repayment will be recalculated.

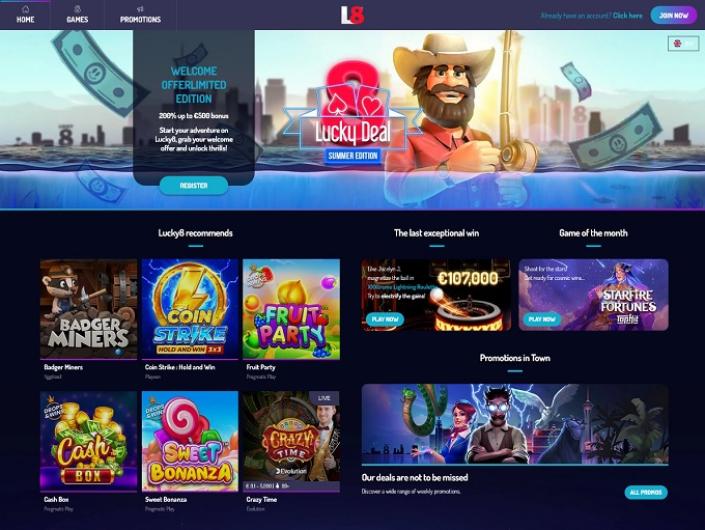

- After signing up for an account and receiving your no deposit bonus credits, you will be given a certain number of days to satisfy the wagering requirements.

- The bank’s two-year fixed rate for remortgage (75percent LTV) has risen to 6.14percent from 5.94percent, with a 999 fee.

- This bonus has a considerably higher-than-average wagering requirement of 50x.

- Broker exclusive residential remortgage deals at 60percent LTV and 70percent LTV as well as some buy-to-let mortgage costs will rise by the full 0.1 percentage point.

For instance, when a new video slot is introduced, an online casino may give out free no deposit free spins to existing clients so they can try out the new game. This type of bonus allows players to familiarize themselves with several games within the casino without risking their real money. However, this type of no deposit bonus is not as popular as the first two.

January: Niche Lenders Join Pricing War

But the options are intended only as temporary measures to help reduce mortgage costs in the short-term and borrowers will usually need to switch back to their previous mortgage terms after six months. Average five-year rates are now at 5.86percent, compared to 4.97percent in May. “Summer holiday season is almost upon us, and the bank is clearly trying to balance the extra workload with a reduced capacity to process applications. Around three million mortgage holders will face the same prospect by the end of 2026. And one million households will see increases to their monthly repayments of 500 or more over the next few years. This could potentially mean an increase of 0.5 percentage points in August (which would take the Bank Rate to 5.5percent), rather than 0.25 percentage points rise many had been expecting.

February: Hsbc Offers 5

There has also been discussion about whether a cut in the Bank Rate two weeks prior to the General Election on 4 July might be interpreted as a political move. The expectation is that the rate will be cut by the Bank of England at its next meeting on 1 August, probably by 0.25 percentage points, taking it to 5percent. It shows there were 664,000 https://happy-gambler.com/kolikkopelit-casino/ interest-only mortgages outstanding at the end of 2023, compared to 702,000 at the end of 2022. Added to this there were 200,000 partial interest-only homeowner mortgages (mortgages that are part interest-only and part capital repayment). This was 9.9percent fewer than at the close of 2022, when the figure was 222,000. Around 400,000 households will see a significant increase in their monthly mortgage payments of 50percent or more.

Would-be landlords with less capital to put into the property can access reduced rates through The Mortgage Works, paying 0.50 percentage points less (5.04percent) for a five-year fix at 65percent LTV, again with a 3percent fee. The bank’s new rates include reductions to product transfer deals and rates for additional borrowing. Nationwide building society has increased its maximum loan to value ratio for self-employed borrowers looking to purchase a home (home mover or first-time buyer) to 95percent. The maximum LTV for remortgage for self-employed homeowners is 90percent with Nationwide. Precise Mortgages is reducing rates across selected residential and BTL products. Skipton building society has made further cuts to its mortgage rates with reductions across its product range taking effect from 9am today.

No Deposit Bonus Codes For Credits Or Bonus Funds

Jump straight into the action without handing over your information or creating an account. Given that these games are ‘free’ it seems obvious to point out their benefits. But there’s more to choosing these games to play than just saving money. These sites are a good barometer for finding the best casino providers and can help you get a shortlist of sites and casino apps that offer your preferred games. This will allow you to find sites which offer these games specifically, and from there you can look to play a free version. You can also find that there are significant terms attached to these types of bonus, and these can have an impact on whether you can easily withdraw any winnings you get from playing with a bonus.

Receiving a welcome bonus without a wagering requirement is a great way to get a feel for a casino without risking your hard-earned cash. You can spin the reels on a highlighted slot, without needing to wager any of your money. Wagering requirements are often placed on your bonus funds after you claim a deposit bonus, it requires you to place a set amount of wagers relating to the initial bonus before you can withdraw your bonus. Grab now up to 120 free spins no wagering and maximize your gameplay!